Uncertainty and risk are always a consideration for any energy efficiency project, and certain areas of project development can introduce more uncertainty and risk than others. The Investor Confidence Project (ICP) is intended to provide a framework for energy efficiency (EE) project development to reduce risk and increase the reliability and consistency of energy savings. The ICP system is designed to provide a comprehensive framework of required elements that is flexible enough to accommodate a wide range of methods and resources that are specific to individual projects.

The ICP Quality Assurance (QA) Specification identifies areas of an energy efficiency project that require greater levels of scrutiny and QA, as well as methods, roles, responsibilities and resources associated with the QA process. The ICP QA Specifications comprise a standardized methodology and evaluation criteria that ensures projects following the ICP protocols conform to the specifications of the protocols.

The ICP team has been soliciting input from industry-experts on an ongoing basis to develop the QA Specification, due for release in late August. A final Technical Forum conference call was conducted on July 29th, to determine revisions that will be considered for the final draft of the document. The following is a list of revisions and topics that resulted from this discussion to be considered:

The ICP Quality Assurance (QA) Specification identifies areas of an energy efficiency project that require greater levels of scrutiny and QA, as well as methods, roles, responsibilities and resources associated with the QA process. The ICP QA Specifications comprise a standardized methodology and evaluation criteria that ensures projects following the ICP protocols conform to the specifications of the protocols.

The ICP team has been soliciting input from industry-experts on an ongoing basis to develop the QA Specification, due for release in late August. A final Technical Forum conference call was conducted on July 29th, to determine revisions that will be considered for the final draft of the document. The following is a list of revisions and topics that resulted from this discussion to be considered:

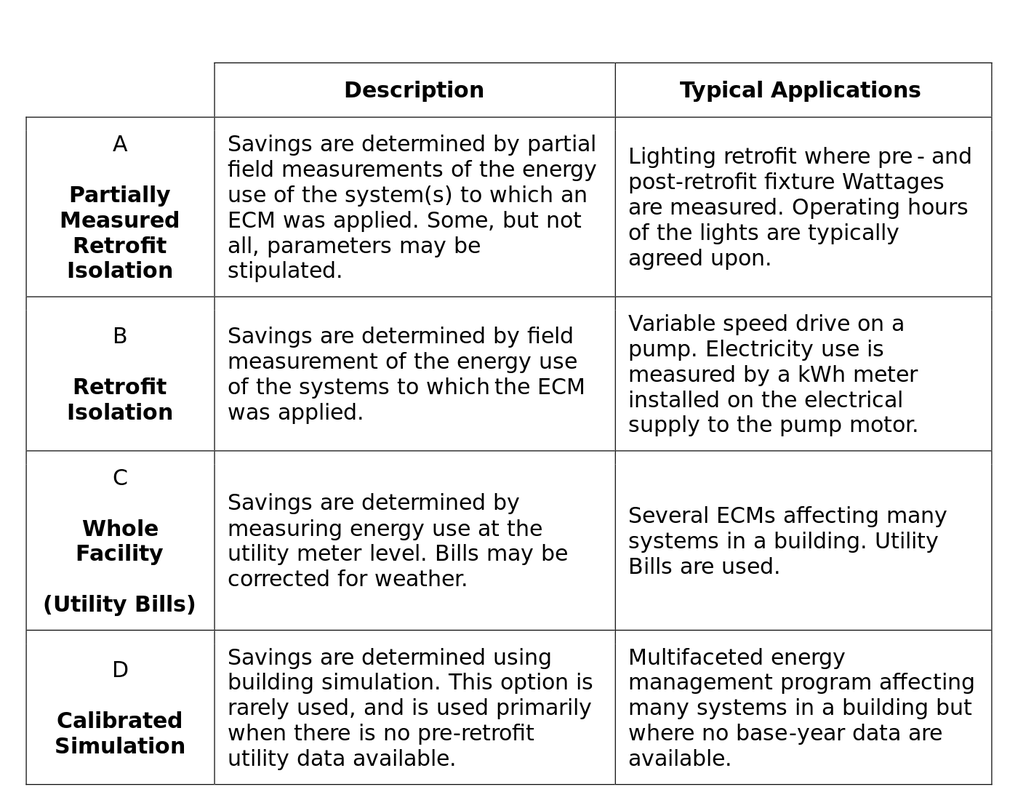

- Differences between the protocols - Discuss the major differences between the protocols, such as: when should energy modeling be used as opposed to spreadsheet or other energy savings calculation methods; when are M&V Options A, B or C most appropriate; etc.

- Flow chart - Consider a flow chart or similar method to describe when project development and QA tasks should be performed, and how these tie into critical financing decision milestones.

- Whole building baseline - It was concluded that a whole building baseline should be developed for all projects, even those only involving a single or a handful of energy conservation measures (ECMs).

- Baseline – Describe the process of developing a baseline upper and lower bound. This involves use of the energy use equation to calculate energy use for the baseline period, and comparison to historical utility bills. Using the error, standard deviation, and confidence/precision levels, create a minimum and maximum baseline – savings should fall within this range to be considered successful).

- Data sufficiency - Application of the BEPA Standard to sub-metered loads.

- Investment criteria - Reinforce the idea that all inputs necessary for the financial evaluation of a potential EE project should be developed by the project development team, such as implementation costs, estimated savings, available incentives, and effective useful life. Input from the investor should be provided regarding appropriate financial metrics and values to use for escalation rates, interest rates, discount rates, cost of capital, lease terms, and other appropriate financial inputs.

- Simple payback is an accepted metric for some projects.

- This protocol is intended for investors of all types. Many programs specifically define the financial metrics and inputs to use for analysis.

- Better define the “project’s useful life” in the savings to investment ratio definition; this is defined as the weighted average of the expected useful life of all measures being considered.

- Energy model calibration - Review and add additional details following ASHRAE Guideline 14 regarding calibration best practices.

- Recommendation of monthly accuracy of the calibrated model to historical utility bills within +/-15% is appropriate.

- Consider greater accuracy in annual calibration, such as +/-5%.

- Risk and uncertainty in the model calibration should be documented and quantified.

- Model should be calibrated to monthly data, and hourly data (if available).

- Energy model resources - A comprehensive list of resources is already provided. Consider adding a resource for available energy modeling engines and front-ends, such as the DOE energy modeling tools library. Consider the paper by Dru Crawley, which compares ten specific energy modeling tools.

- ECM modeling - Currently describes an iterative approach, and ECM bundled packages. Seek input on other potential approaches to ensure that interactive effects are being properly represented.

- Savings calculations - Reference the uncertainty analysis methods described in the “Uncertainty and Risk” section of the specification in the Savings Calculation section. Uncertainty and risk best practices and quantification methods should be applied to the energy savings estimates.

- Operational Performance Verification (OPV) - Term used to describe the commissioning process applied specifically to the ECMs (differentiates it from a whole-building commissioning effort).

- Does the term “OPV” capture the intent, requiring complete commissioning of the process as it is applied to the project?

- Would terms such as “targeted commissioning” or “project commissioning” better convey the idea being promoted?

- Requires further discussion.

- M&V - Will add short definitions of Options A, B and C, as well as when these are best applied based on the project or ECM type.

- Uncertainty and risk - Will add references to this section in other sections of the specification as appropriate. Will also add mention of Latin Hypercube sampling in addition to Monte Carlo method.

RSS Feed

RSS Feed