Andy Darrell, Chief of Strategy for the EDF Climate and Energy Program, representing the Investor Confidence Project and gave this clear, concise, and winning explanation of why ICP is transformative to cities and energy efficiency:

Finance for Resilience (FiRe), a platform designed to crowdsource and champion new ideas to accelerate finance for clean energy, low-carbon infrastructure, and sustainable cities, recently hosted over 1000 energy-sector and finance leaders at the Bloomberg New Energy Finance (BNEF) Future of Energy Summit. At this summit, eight vetted finalists were featured in a competitive pitch process that resulted in the selection of four 2016 FiRe winners including EDF's Investor Confidence Project. Andy Darrell, Chief of Strategy for the EDF Climate and Energy Program, representing the Investor Confidence Project and gave this clear, concise, and winning explanation of why ICP is transformative to cities and energy efficiency:

Comments

ICP to Help Open Up €100 Billion Energy Renovation Market in Europe Environmental Defense Fund’s Investor Confidence Project Europe (ICP Europe), supported by the European Commission’s Horizon 2020 programme, today released a robust set of project guidelines to facilitate investment in the building energy renovation market. Building owners, project developers, finance and energy service providers, insurers, local authorities, and utilities all stand to gain from the ICP system, which offers transparency and accountability to the energy efficiency market by standardising how projects are developed, maintained, and measured. Only half of the estimated €60 – 100 billion investment needed annually to achieve Europe’s 2020 building energy efficiency targets is being met, according to the United Nations Environment Programme. ICP Europe’s new protocols aim at narrowing this gap significantly by enabling investment for building energy renovation. In collaboration with industry stakeholders and with support from philanthropic donors, the Investor Confidence Project developed its ICP Europe Protocols to define European best practices for predicting energy savings, optimising performance, and monitoring the results of energy efficiency investments. These protocols enable the acceleration of energy efficiency investments and the emergence of a robust and thriving commercial renovation sector by increasing confidence in the engineering fundamentals and financial returns of projects. “We are happy to fund Investor Confidence Project through the Horizon 2020 programme. It has the potential to transform the market by making building energy retrofits a standardised product for the finance industry,” said Vincent Berrutto, Head of the Energy Unit at the European Commission’s Executive Agency for Small and Medium-sized Enterprises. “This will contribute to reducing transaction costs and make finance more affordable.” “We are involved in the Investor Confidence Project Europe for purely business reasons: we believe it is a necessary step to unlock the capital our sector requires to meet Europe’s energy goals,” said Stephen Barker, Head of Energy Efficiency and Environmental Care at Siemens in the United Kingdom. “The ICP Europe project is key to put in place the right framework in order to unlock the financial stream needed to achieve the cost-effective potential of energy savings which exists in the buildings sector, therefore unleashing the multiple benefits linked to building renovation,” added Adrian Joyce, Secretary General of EuroACE. “For all stakeholders, a clear positioning of the values and benefits of Energy Performance Contracting, together with project financing represent the most crucial issues. The ICP Europe Protocols structure the necessary data, which in turn enables the underwriting and facilitates the management of energy performance risks. This is a welcome support for the development of the European Energy Performance Contracting market with the longer term goal of reaching maturity”, said Volker Dragon, Chairman of eu.esco. “We are honored to partner with public and private sector leaders in Europe to help accelerate a global asset class for energy efficiency,” said Andy Darrell, Chief of Strategy Global Energy and Finance, Environmental Defense Fund. “Wasting less energy is an essential step to prosperity with less pollution: the Investor Confidence Project can help bring that future within reach for families, businesses, communities and cities across Europe.” ICP Europe has forged strategic alliances with the financial, real estate, and efficiency sectors to develop project origination and underwriting standardisation through its protocols, which help to reduce transaction costs and accelerate deal flow for building renovation projects. ICP has attracted interest from the Energy Efficiency Financial Institutions Group, (including Siemens Financial Services, Deutsche Bank, ING, Allianz, and BNP Paribas) which cited investor confidence as the top priority for transforming the energy efficiency market. “Governments and NGOs have for years been talking about how energy efficiency is the low hanging fruit that can bring a healthy return on investment. But, despite the actions of a few market leaders, investing in it is not as easy as it’s made out to be – or everybody would be doing it,” said Dr. Steven Fawkes, Senior Advisor for ICP Europe and a member of the Investment Committee of the London Energy Efficiency Fund with 30 years of experience in the energy efficiency sector. “With the release of the first six renovation protocols, ICP Europe is helping energy efficiency become a standardised product and, thus, an indispensable part of every institutional investor’s portfolio.” Interested parties are invited to contribute to ICP Europe’s efforts through the Technical Forum and help make energy efficiency a global asset class by joining the ICP Europe Ally Network.  New Jersey’s Clean Energy Program (NJCEP) is launched and will incorporate the Environmental Defense Fund (EDF)’s Investor Confidence Project (ICP) energy efficiency protocols into the state’s Pay for Performance (P4P) program as an alternative compliance path. The Pilot is designed to assess the benefits of adopting ICP protocols for NJCEP’s commercial and industrial projects with a goal of:

The program is currently accepting projects into the P4P/ICP Pilot. Program Offerings and Incentives The ICP Pilot will offer up to $35,000 of additional incentives to qualifying Investor Ready Energy Efficiency™ certified projects and conducting measurement and verification. Get Involved

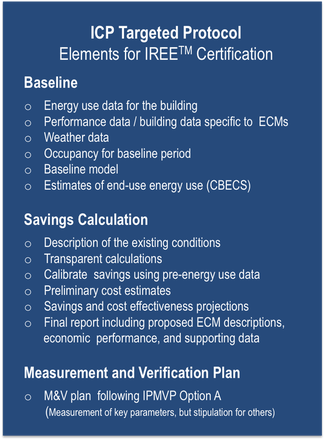

If you are a credentialed project developer or part of the ICP Investor Network, we would love to help you get involved in this exciting new opportunity. Please contact us and we would be happy to discuss next steps, and facilitate introductions.  The California Commissioning Collaborative will be hosting a webinar on the the Investor Confidence Project on Wednesday, February 17 at the CCC's next lunch and learn webinar. We need to talk about... The link between investor confidence and commissioning Commissioning doesn't usually arouse the interest of investors, but that doesn't mean it shouldn't. The Investor Confidence Project (ICP) provides a suite of protocols, existing industry certifications, and third party verification to support "investor-ready" energy efficiency projects. ICP is intended to attract much-needed private capital that can help grow the energy efficiency industry. And it could be great news for the commissioning industry! ICP could help drive more demand for commissioning projects and offer new business opportunities to commissioning providers. This webinar will provide insight on how to become a credentialed provider, how to certify a project, and how ICP can be used to support commissioning projects. Presenters: Matt Golden, Senior Energy Finance Consultant, EDF Tracy Phillips, Technical Lead, Investor Confidence Project Wednesday, Feb. 17th 2015 12:00 noon - 1:00 pm Pacific This webinar is open to the public and free of charge. Register for the webinar CCC meetings cover the hot industry topics, and include technical presentations, case studies, program discussions, and networking opportunities. You can view agendas and presentations from of our past meetings here. You’ve got a small project, with limited resources and a short deadline; but you want to generate an Investor Ready Energy Efficiency™ (IREE) project that complies with the Investor Confidence Project (ICP) requirements. Can it be done? No problem. Developing a project based on the ICP protocols, especially on simpler projects, likely already aligns with much of what you are doing. The ICP team works closely with stakeholders to develop requirements that reflect industry standard practices and methods which most firms are already conducting in one way, shape or form.  Let’s examine the requirements of the ICP Targeted Protocol, which is geared toward “smaller” projects typically involving just one measure or a handful of measures with limited interactivity. While digging into the ICP protocols can sometimes seem daunting, we have found that in general most project developers are already doing most, if not all, of the required steps to develop a project that is ready for certification. Once a project has been completed for underwriting, the final step for Investor Ready Energy Efficiency™ Certification is to have an ICP Quality Assurance Providers review documentation, make sure all of the components have been developed properly, and to check them for technical rigor. And that’s all it takes to produce an IREE™ certified project. Do the requirements above sound like how you already develop projects? If so, then you’re ready to start using ICP to develop an IREE project. If you are interested in starting to use ICP IREE™ certification for your projects, please contact us and we can help you get going.  Doing Energy efficiency right just aint simple. Yet a key goal of the Investor Confidence Project (ICP) is to reduce transaction costs and streamline the origination of energy efficiency projects. While it is tempting to cut corners during development, projects that deliver reliable results require a detailed approach to engineering and independent review to provide confidence to building owners and investors. A question we consistently hear is “what is the cost of quality assurance?” There is not a clear answer to this question, as outside of ICP’s efforts there is not much standardization surrounding what a QA process consists of. What is clear is that the lack of standardization affects both the cost and quality of these efforts and clear requirements for both project developers and quality assurance providers reduce the time and costs of the process. With this in mind, the ICP Technical Forum met on October 15, 2015 to discuss and come to agreement on preliminary estimated levels of effort associated with the QA tasks associated with the development of ICP Certified Investor Ready Energy Efficiency™ (IREE™) projects. The result of this meeting represents the first published attempt to determine average industry review time and cost estimates. The ICP project development process is divided into two periods. The Underwriting Period is comprised of all activities leading up to securing project financing, and includes all baseline development tasks and information gathering, savings calculation tasks, and the development of the Operational Performance Verification (OPV or targeted-commissioning) plan, the Operations, Maintenance and Monitoring (OM&M) plan, and the Measurement and Verification (M&V) plan. After successfully meeting the underwriting period requirements, a project is then eligible to be certified as IREE. The Performance Period is comprised of tasks that occur during construction and continue into the performance period of the building, and include actual performance of the OPV activities, OM&M activities, M&V activities, updating of various manual(s), and training of the facility personnel. There are QA activities associated with both periods. The term “Quality Assurance” can mean a number of things. Although there is no standardized definition, our stakeholder group agrees that in general there are basic “documentation reviews” and much more in-depth “technical reviews” that can involve some or all tasks associated with the project. ICP related compliance reviews are documentation reviews focused on ensuring that all ICP specified documentation is available and completed in accordance with the requirements of ICP and the standards we reference. The Technical Forum examined the entire scope of possible QA activities associated with all stages and types of reviews. For each task, stakeholders discussed and came to agreement on the potential minimum and maximum number of labor hours associated with the QA effort. These hours were then aggregated according to the type and stage of the review resulting in the following estimates: While the number of hours will always vary based on the size and complexity of the project, the results of this exercise suggest that to perform a complete review supporting ICP IREE™ certification will typically range from twelve to 63 hours of review time assuming that the project was initially developed in accordance with ICP by an experienced project developer.

Typically, the majority of these costs are already embedded into projects in the form of independent desktop reviews required by incentive and other programs or specified by savvy building owners and project developers. One of the goals of ICP is to have the full range of investors accept a project that has been certified and reviewed without the need for redundant process. ICP believes strongly in the value of an independent review of documentation to ensure the quality of project fundamentals and the reliability of financial projections. The benefits of such a review are far greater than the costs, which make up a very small portion of most projects. One of the primary goals of ICP is to ensure that structured reviews by trained experts on standardized projects done once and done right, will result in more economical process and lower transaction costs. We are working with credentialed project developers, software providers, and QA providers to optimize this workflow and encourage all stakeholders to contact us to get involved. For those interested in viewing detailed results of this effort, the QA Task Estimate Spreadsheet is available online.

ICP Project Development Templates are first of a kind ready-to-use templates that take the time and cost out of developing the key performance period plans required for Certified Investor Ready Energy Efficiency™ projects. Developed in collaboration with stakeholders, these templates have been designed for users to customize the contents and language to fit owner or project specific requirements, and generally based on information already developed for the project. ICP requires that at the time of IREE™ Certification these actionable plans are in place, so that building owners and investors can ensure that projects are implemented, maintained, and measured through the performance period of thier projects to make sure they achieve thier energy savings potential. The ICP system provides the plan as part of the underwriting pacakge, but we rely on those taking risk on the savings to ensure that the plans are executed on. We are pleased to release templates for Operational Performance Verification (targeted commissioning), Operations Maintenance and Monitoring, and Measurement and Verification.

Operational Performance Verification (OPV) Plan Template: The OPV plan can be used directly to describe the targeted commissioning process to support Investor Confidence Project (ICP) compliant projects that use either in-house or third-party commissioning providers.

Operations, Maintenance and Monitoring (OM&M) Plan Template: This OM&M plan template provides a framework and outline for creating a project specific OM&M plan. The OM&M plan can be used directly to describe the OM&M process to support Investor Confidence Project (ICP) compliant projects. This OM&M plan can be used as a stand-alone document, or included as an appendix to the commissioning (OPV) plan.

Measurement and Verification (M&V) Plan Template, Option C:

This M&V plan template provides a framework and outline for creating a project-specific M&V plan adherent to the IPMVP Option C, Whole Facility approach. The M&V plan can be used directly to describe the M&V process to support Investor Confidence Project (ICP) compliant projects. This M&V Plan template was developed with contributions by David Jump of Quantum Energy Services & Technologies, Inc. (QuEST), and the EVO IPMVP Committee. Templates for IPMVP Option A and Option B are under development, check back soon!  Buildings use nearly 40 percent of all energy in the U.S., so improving their efficiency is key to a clean energy future. Because increasing deal flow in the energy efficiency market has been a challenge, Environmental Defense Funds’ (EDF) Investor Confidence Project (ICP) announced today the launch of its Investor Network to help connect investors in search of quality energy efficiency projects with project developers of buildings in need of capital. Offering investors a common language to compare project risks and savings makes projects simpler, decisions easier, and project performance more reliable. “The Investor Confidence Project helps create a pipeline of investor-ready projects to meet growing demand within the building sector” said Andy Darrell, EDF’s Chief of Strategy, Global Energy & Finance. “We are thrilled to see these investors looking for ways to deploy capital into energy efficiency and look forward to helping close the gap between opportunity and a robust marketplace of smart investments.” EDF’s Investor Confidence Project creates certified energy efficiency projects that make investing in what are often complex projects easy for building owners and investors alike. The new Investor Network was developed to help address the needs of investors looking for standardized projects that reduce the time, risk, and costs involved in funding energy efficiency projects. Reviewed by an independent engineer, each ICP-certified – or Investor Ready Energy Efficiency™ – project has provided consistent documentation for each step in the process. By certifying projects against an industry standard, ICP reduces transaction costs and increases confidence in savings in order to help engage private capital and scale up energy efficiency investments globally.

Members of the Investor Network make up around $1B in financing for energy efficiency projects collectively and range from leading providers of debt and equity to finance projects, to insurance providers and energy services companies. Members include Bluepath Finance, CleanFund, Commercial PACE Capital, Energi, Hartford Steam Boiler, HUB International, Joule Assets, M-core Credit Corporation, Metrus Energy, Noesis, Petros PACE Finance, ReNewAll LLC, Renew Financial, and Spark Fund. A majority of Investor Network members are demonstrating the value ICP provides by offering incentives such as accelerated underwriting, reduced transaction fees, and preferable terms for Investor Ready Energy Efficiency™ projects. Members actively voicing their support for the Investor Confidence Projects and its Investor Network include: “As an investor in Property Assessed Clean Energy, or PACE, energy efficiency deals, the most critical factor we’re looking for is confidence in savings and returns – of which the Investor Confidence Project is vital to building,” said John Kinney, Founder and Chairman of CleanFund. Mike Bahr, Co-Founder & Managing Partner of ReNewAll, who is both a project developer and investor, summed up their support for ICP by saying, “we believe ICP has the potential to benefit the entire energy efficiency ecosystem. The ICP standards provide a common roadmap for project development and the ICP credentialing system ensures that energy efficiency projects will be developed consistently. The net results are projects that investors, programs, and building owners can depend upon to perform as designed.” Mansoor Ghori, Managing Director of Petros Partners, who is an active Property Assessed Clean Energy (PACE) investor, says “ICP can play a crucial role in enabling deal flow in developing energy efficiency markets, such as the PACE market here in Texas. ICP's standards-based approach facilitates the underwriting of projects, which is why Petros is offering expedited underwriting for Investor Ready Energy Efficiency™ projects.” Interested investors can find more details on ICP’s website. To get in touch with any of the Investor Confidence Project’s Investor Network members about funding for energy efficiency projects or to find out more about ICP, contact info@eeperformance.org.

|

Archives

July 2023

Categories

All

|

||||||||||||||||||||||||||||